TrueBill AI

My team, “Finnovators”, which consisted of me and 3 of my friends (Omm, Miloni and Vansh) were a part of the Finnovate 2025 Hackathon. This was a 24-hour Hackathon conducted from 7 November – 8 November, 2025, where we built an app to solve quite a substantial problem faced by finance firms. Big firms deal with thousands of invoices, bills and quotations per day. These often have to be manually checked for discrepancies and malice. Humans tend to take a lot of time checking for these discrepancies, and some sly cheats might get by. This is why we implemented a solution to automate the entire process.

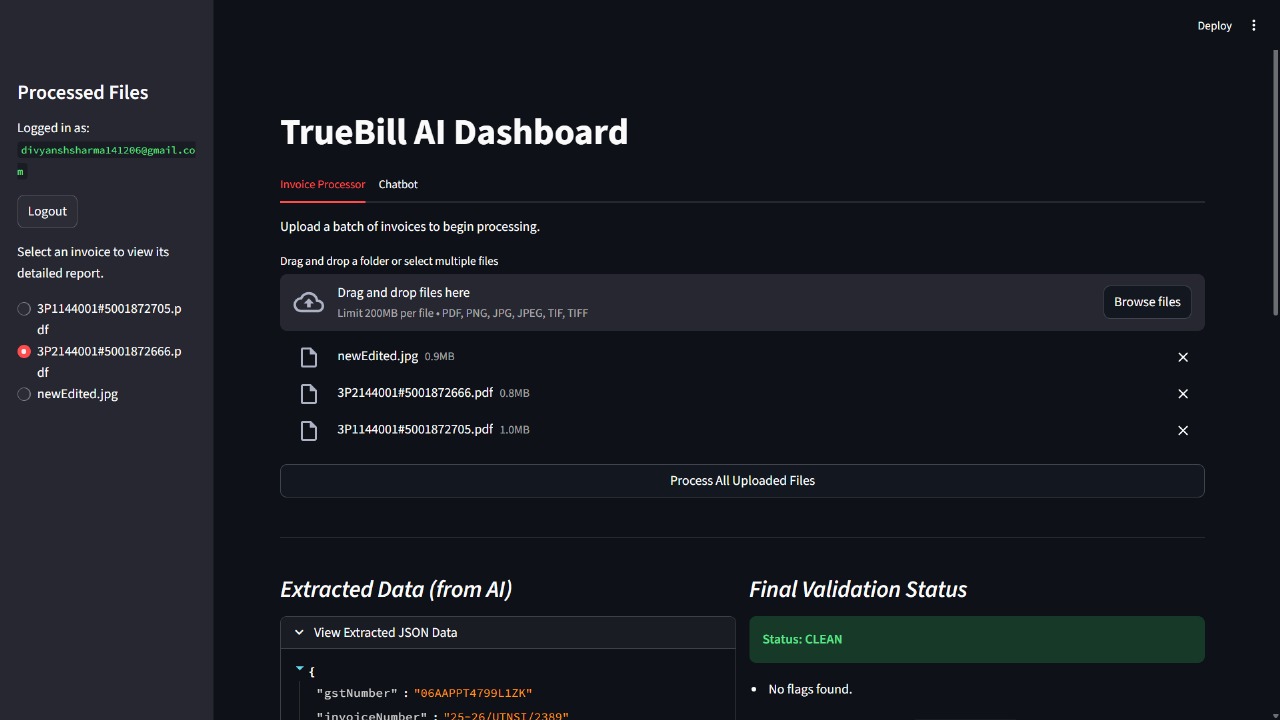

TrueBill AI was created in 24 hours as a complete solution which implements this pipeline. You can upload invoices in most common unstructured formats (PDF, PNG, JPG, TIFF) as a batch. This batch would be processed in parallel (asynchronous implementation), but, since the free API rate limits the app anyway, this does not make it any faster than serial execution (Bummer, I know). The data from these invoices is extracted, stored in a structured format, and run through a 4-step validation process. Clean invoices and flagged ones are stored separately, and a chatbot addresses any questions about the invoices in the database.

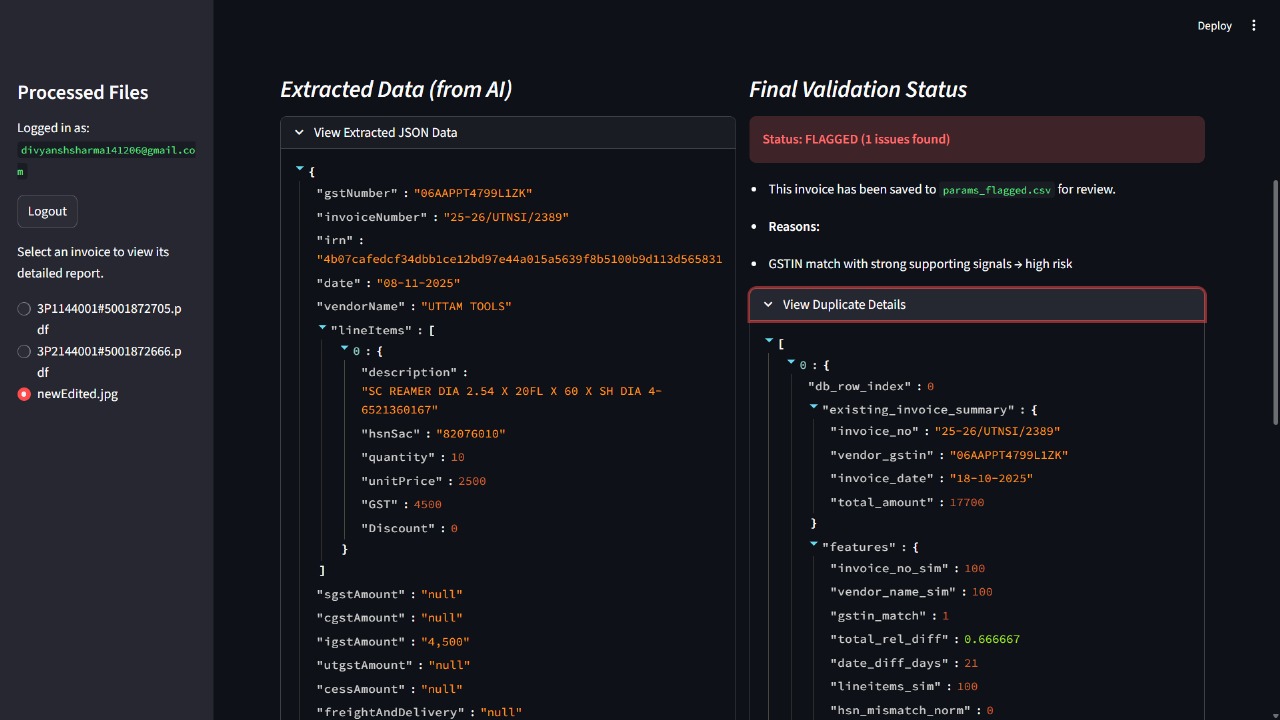

Data Extraction is done using Gemini MultiModal API. Locally run OCR models were too inaccurate for us to use, even after preprocessing images. The unstructured data gets converted into a structured JSON format, which can be read for validation. Validation happens over a four-step process.

First, the GSTIN number of the bill is identified. If it is invalid, the invoice is flagged. This is the first part of the validation process. Secondly, the invoice passes through an arithmetic sanity check. The calculations in the invoice, including addition, discounts and taxes, are checked. A discrepancy of more than 1 Rs is flagged. The invoice then goes through GST rate validation. All items/services are scanned for HSN/SAC codes. This is used to find the corresponding applicable GST rates for that entry. Differences are flagged again.

After passing through this validation pipeline, the invoice must go past the duplication check. This checks for similarities between this bill and previous entries stored in the database. It acts as the final frontier for maliciously altered bills. Any alterations to a saved bill, like the name of the vendor, date, item name, price, etc., are inspected. This validator also takes into account price discrepancies, while keeping inflation in mind. The validator gives a heuristic score to the bill, which is a measure of the confidence of fraud in the invoice.

The app asks the user for their email ID. The app does not have an account fucntion. Email IDs are required only to send reports of flagged invoices in the dumped batch, after they have all been validated.

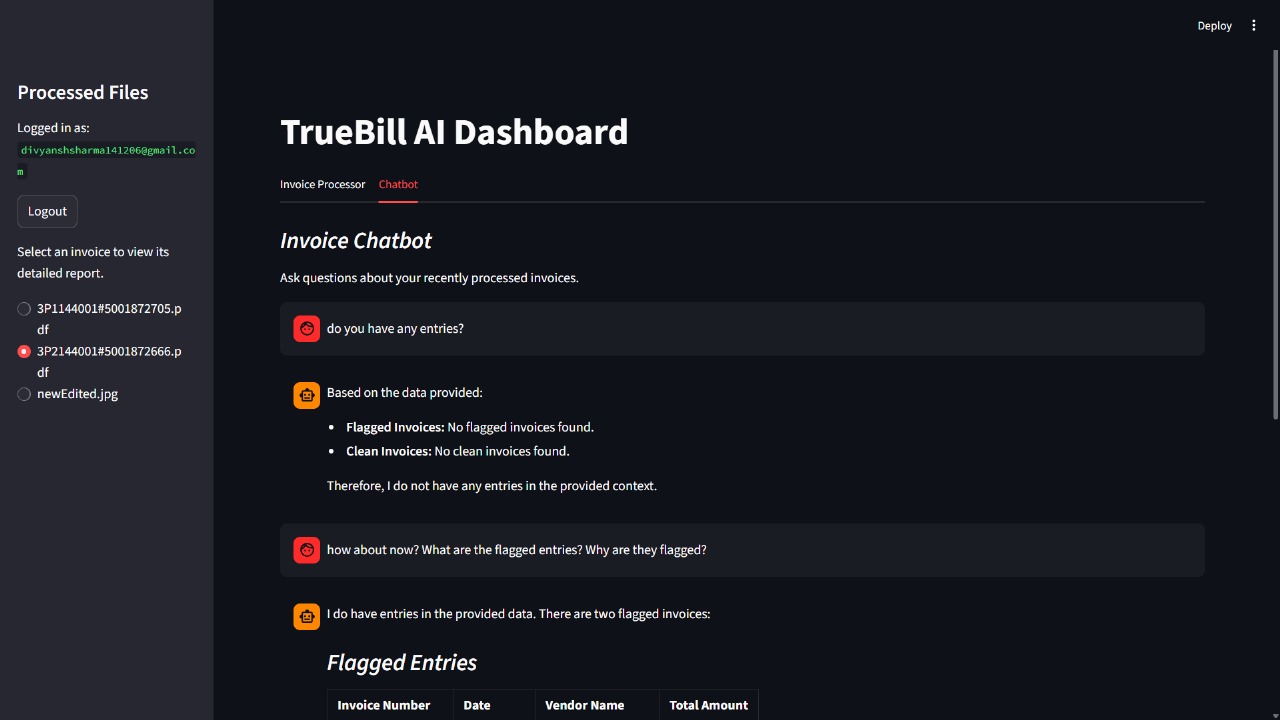

TrueBill AI comes with a chatbot which has access to the database which stores the clean and the flagged invoices, and the reasons for the flagged invoices. Users can talk to the chatbot in natural language to query the database. Currently, the data extraction, GST rate calculation and chatbot is done using free tools. The entire model can be improved and made exponentially faster using better models.

Despite the limitations of free APIs and our short 24-hour window, TrueBill AI stands as a strong proof of concept for automated invoice verification in large-scale financial workflows. The project pushed us to design an end-to-end system — integrating multimodal AI, data validation, and natural language interaction — all under tight constraints.

While we didn’t bag a prize at Finnovate 2025, the experience was incredibly rewarding. We learned how to coordinate effectively under pressure, implement asynchronous workflows, and handle real-world FinTech data challenges. TrueBill AI represents not just a hackathon project, but a glimpse into how AI can transform financial compliance and fraud detection in the near future.